The stablecoin market is a major part of decentralized finance, it is about offering users a dependable bridge to the digital economy by maintaining a stable value pegged to traditional currencies. We’ve seen during the past months that the need for stablecoins that generate passive yields while guaranteeing security grows increasingly clear.

That’s why sUSD was created: the first synthetic stablecoin on Solana backed by Real World Assets like U.S. Treasury Bills and structured to support financial accessibility on the open internet. sUSD’s strategy is to combine decentralization, backing and yield mechanisms, sUSD represents the next generation of stablecoins – here’s how.

Solayer: Powering the sUSD Ecosystem

Solayer is the essential infrastructure behind sUSD, enabling decentralized access to yield-bearing assets on the Solana blockchain. It powers sUSD’s unique combination of RWA-backed stability and consistent income generation, all while ensuring optimal functionality and security for users. The heart of Solayer is a SOL restaking protocol, where users can deposit their native SOL or liquid staking tokens to participate in a restaking pool that not only supports Solana’s security but also channels yields from U.S. Treasury Bills, which back sUSD. This restaking model is fundamental to sUSD’s passive income feature, allowing holders to enjoy stable returns while bolstering network security.

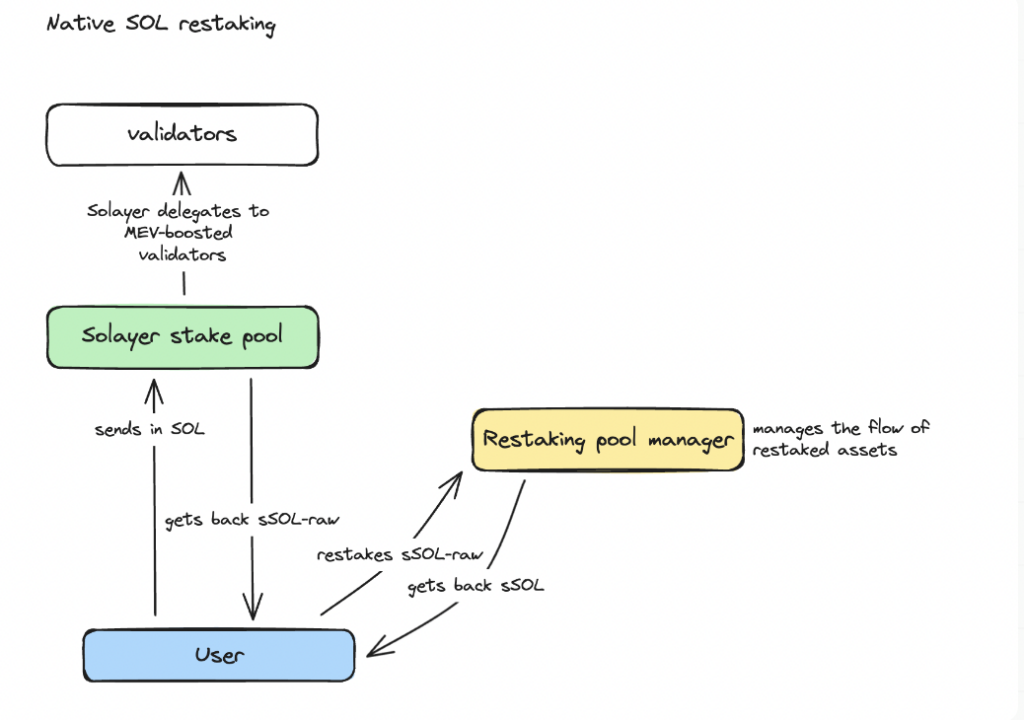

To give you a clearer picture of how this works, here’s a simplified diagram that illustrates the flow of assets within the Solayer restaking protocol. It shows how users deposit SOL into the Solayer stake pool, receive sSOL-raw in return, and how these assets are managed by the restaking pool manager. The manager ensures assets are delegated to MEV-boosted validators, generating yield that supports sUSD’s income feature. This process not only creates passive income for users but also reinforces Solana’s security, aligning individual rewards with network resilience.

Solayer’s Request for Quote mechanism plays a crucial role in managing Real World Assets to back sUSD. This system strategically aligns the issuance of stablecoins with RWA-backed reserves, fortifying sUSD’s peg and ensuring user trust in the stablecoin’s financial backing. Additionally, when users deposit SOL into Solayer, it is converted into a native Liquid Staking Token called sSOL-raw, which serves as a bridge between the Solana ecosystem and the yield-bearing capabilities of sUSD. This token structure allows Solayer to secure users’ holdings on-chain while generating returns backed by real assets.

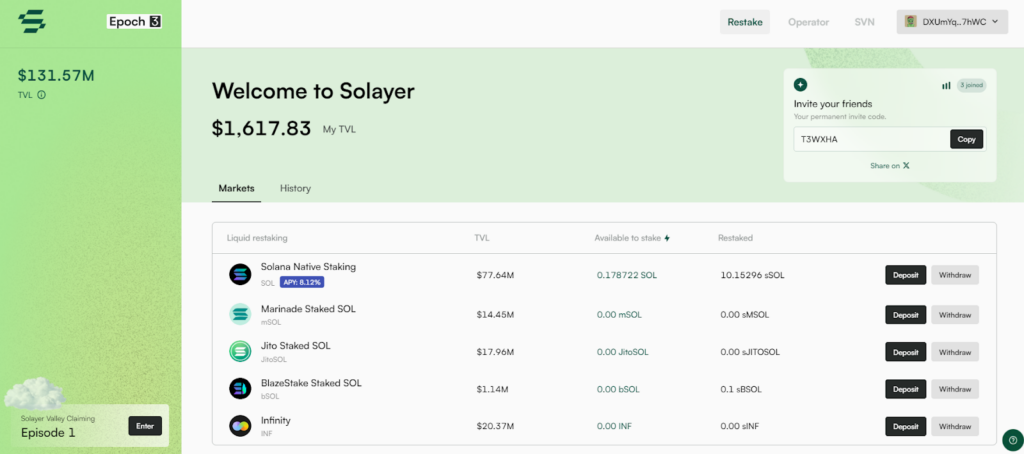

In terms of yield distribution, Solayer simplifies the process by automatically growing the value of sUSD over time. Instead of requiring users to manually claim or stake for rewards, the yield is added to their wallets through a multiplier mechanism, allowing them to passively benefit without additional steps. Solayer also offers an accessible dashboard where users can view their holdings, track interest growth, and manage their deposits and withdrawals with ease, making the yield-bearing features of sUSD intuitive and accessible even to newcomers.

The platform places a high emphasis on transparency, particularly in its withdrawal processes. Users can access both their SOL and LST holdings, including accumulated rewards, at any time, with an easy, clear procedure. Through this combination of restaking, strategic RWA management and yield automation, Solayer is powering the sUSD ecosystem to provide a reliable and decentralized stablecoin experience.

What Sets sUSD Apart?

In a sea of stablecoins pegged to fiat currency, sUSD differentiates itself in three fundamental ways: it’s yield-bearing, backed by RWAs and powered by Solana’s blockchain. These features give it a unique positioning and unparalleled appeal for users who are looking for stability and income generation within a decentralized ecosystem.

- RWA-Backed Security

Unlike most stablecoins that rely on reserves of digital assets or fiat collateral, sUSD is backed by Real World Assets, specifically U.S. Treasury Bills. These government-backed securities provide a safe foundation for the stablecoin, making sure it maintains its 1:1 peg with the U.S. dollar. It is an important foundation to underscore sUSD’s resilience in market downturns. - Yield-Bearing Stability

As a yield-bearing stablecoin, sUSD generates a 4-5% annual return through its T-bill backing. When sUSD is leveraging these high-security assets, it delivers a consistent yield that accumulates directly within users’ wallets. The stablecoin’s “interest-bearing extension” functions like a savings account, allowing the holding amount to grow automatically without requiring active staking or manual yield claim processes. - Decentralized Accessibility

Built on the Solana blockchain, sUSD offers permissionless and decentralized access to stable yield. This means that anyone with an internet connection can benefit from its features. This decentralized model opens doors for millions of users across the globe, especially those who lack access to traditional banking systems, marking a significant step toward financial inclusion.

How sUSD Works: Core Mechanisms and Yield Generation

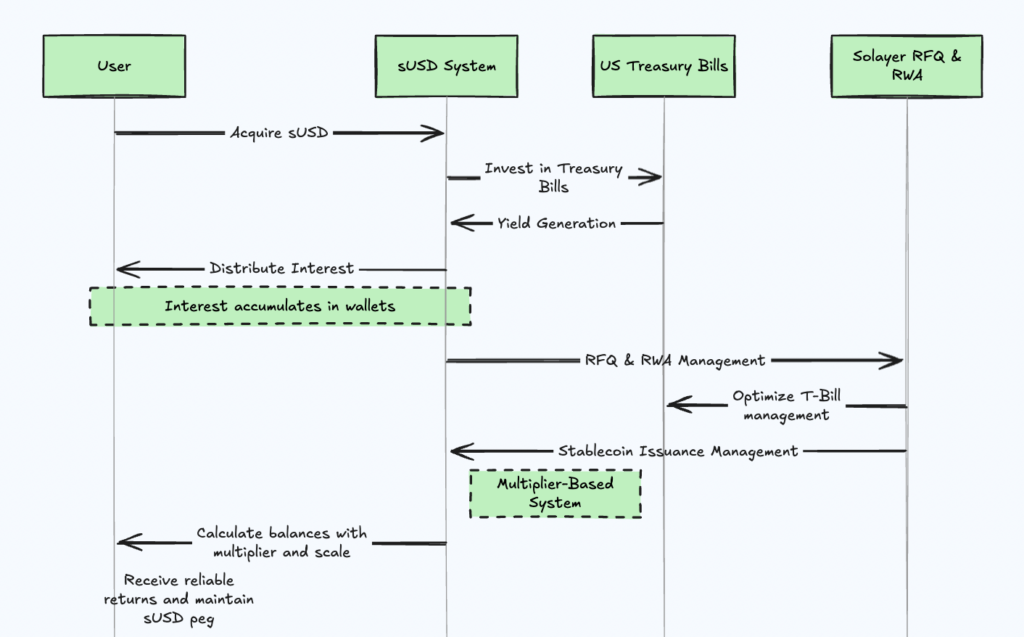

Yield Generation through T-Bills

sUSD’s yield stems from U.S. Treasury Bills, a short-term government debt instrument that provides a secure income source. The yield generated is seamlessly distributed to users’ wallets as interest accumulates, operating similarly to a traditional bank account that grows with accrued interest. This setup ensures that users benefit from the stablecoin’s growth without complex processes or staking requirements.

Solayer’s RFQ & RWA Mechanism

A pivotal component of sUSD’s ecosystem is Solayer’s RFQ (Request for Quote) mechanism, which supports RWA backing by ensuring that assets like T-bills are optimally managed and matched with stablecoin issuance. Through this mechanism, it supports liquidity, stability and allows sUSD to maintain its peg while providing users with reliable returns.

Multiplier-Based Interest Accumulation

Due to Solana’s account structure, directly minting interest to every holder can be complex. Instead, sUSD employs a multiplier-based system that calculates user balances based on a “scale” that reflects interest growth. It is a necessary approach that allows the value of each sUSD holding to grow without needing to adjust individual wallet balances directly.

sUSD Use Cases: A Multifunctional Stablecoin

With its RWA-backed stability and automated yield distribution, sUSD has a spectrum of applications within the DeFi ecosystem:

- Savings Account on Solana: sUSD functions as a “crypto savings account,” allowing users to hold and earn yield without staking or other complicated DeFi mechanisms. This passive income potential makes it attractive for both retail and institutional investors.

- Secure Collateral for Decentralized Finance : As a stable and yield-bearing asset, sUSD can be used as collateral in lending and borrowing platforms, bolstering the safety of DeFi transactions and supporting leveraged trading strategies.

- Payment Option for dApps: With its stability and yield generation, sUSD serves as an ideal payment medium for decentralized applications, offering both users and developers a low-volatility and income-generating alternative.

- Boosting Decentralized Security: sUSD also contributes to the security of Solana’s blockchain, participating in Solayer’s RFQ mechanism, which reinforces economic stability across the Solana ecosystem and the broader DeFi landscape.

How to Get Started with sUSD on Solayer

If you’re interested in using sUSD, here’s a quick guide on how to get started with Solayer’s native SOL restaking infrastructure:

- Navigate to the Solayer Dashboard

Choose to deposit either native SOL or a compatible Liquid Staking Token (LST), such as Marinade-SOL (mSOL), JitoSOL, Blaze-SOL or Infinity-SOL.

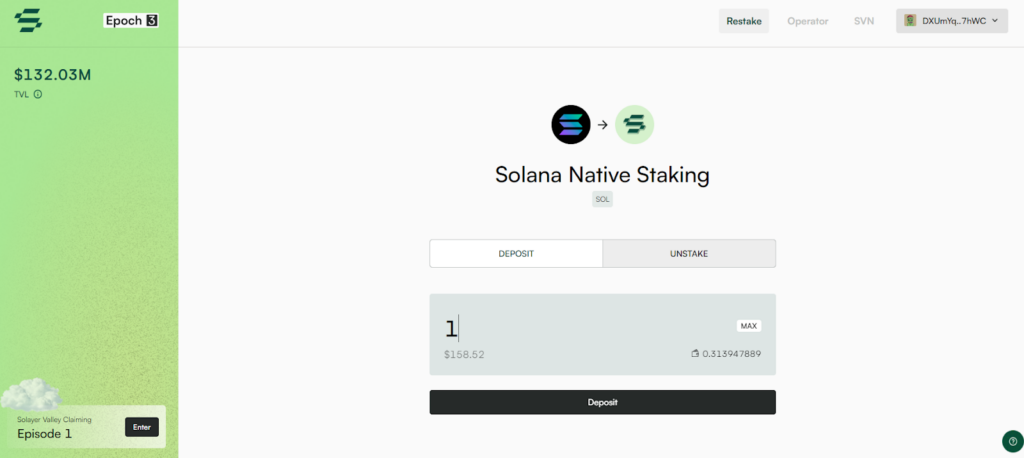

- Select and Deposit Your Token

After selecting the amount of SOL or LST to stake, confirm the transaction. Solayer then converts your SOL into a native Liquid Staking Token called sSOL-raw and transfers it to the Solayer restaking pool.

- Automatic Yield Accumulation

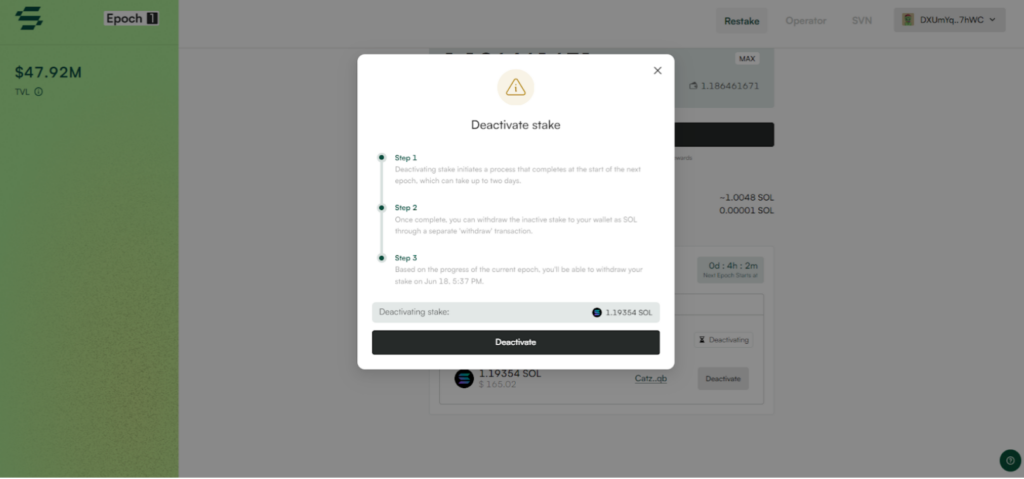

Once deposited, your sUSD balance will grow automatically, reflecting the interest generated from U.S. T-bills. This yield is accumulated natively, making sure you benefit from passive income while maintaining complete ownership of your assets. - Withdrawing Your Funds

When ready, you can withdraw both SOL and LST holdings, along with accrued rewards, to your wallet. Solayer’s withdrawal process is streamlined and transparent, providing an intuitive experience for both novice and experienced DeFi users.

Why sUSD is Critical for Decentralized Finance

The demand for more stable, yield-generating assets becomes clear. sUSD not only meets this demand but also sets a new standard for stablecoins, combining the security of traditional finance with the decentralized, accessible nature of blockchain technology.

sUSD’s combination of yield generation, RWA-backin and Solana-powered decentralization presents a unique value proposition to DeFi researchers, crypto investors and users around the world. The introduction of a stablecoin that not only maintains its peg but also provides a steady income is an advancement for both DeFi applications and individual users.

Whether used as collateral, for secure payments or as a straightforward savings tool, sUSD holds potential to expand the reach and impact of decentralized finance across the global economy.

Conclusion

Think of sUSD as the next big leap in how we handle digital dollars, it’s like combining the best of both worlds: the innovation of crypto with the reliability of real-world assets. Built on Solana and backed by Solayer’s smart technology, sUSD isn’t just another stablecoin. It’s your money, working smarter for you, generating extra income while you hold it.

What makes sUSD truly shine is how it brings together three key elements: the security of real-world assets, the ability to earn yields without lifting a finger, and the freedom of decentralized access. This makes it a powerful tool for anyone looking to navigate the DeFi ecosystem with confidence. By connecting traditional financial stability with the power of blockchain, sUSD is changing how we use stablecoins – whether you’re saving, borrowing, or trading.

If you’re looking to save for the future, need reliable collateral for your DeFi activities or just want a better way to handle your digital money, sUSD has got you covered. It’s bringing the stability we all love about traditional finance into the exciting world of crypto, but with an important twist – your money doesn’t just sit there, it grows.

We’re not just talking about another crypto project here. This is about changing how we think about stable digital money. sUSD is opening doors for everyone to access better financial tools, earn passive income, and participate in the future of finance. The best part? It’s all backed by real assets, so you can sleep better at night knowing your money is safe.

The future of stable digital money is already here, and sUSD is leading the way. It’s time to experience what truly modern money can do for you in the world of DeFi.

📚 Similar content you might like:

👉 Bitrefill Gift Card Honest Review 2024 💙

👉 Holyheld review: the best non-custodial crypto card? 💳

👉 The Secret on How to Earn Disney Gift Cards Fast: 7 Easy Ways You Can Start Today! 🎁

👉 Best Gift Cards for Men: my Top 10 Picks 💛

📌 Never miss a new post! Follow us:

👉 Linkedin

👉 X (Twitter)

👉 Facebook

👉 This article is provided by Web3Lens, learn more about us here.