Why we find the Nexo Card interesting

Let me tell you about the Nexo Card. This card helps people spend their cryptocurrency without needing to sell it first. Many folks like it because of how easy it is to use. Cashback rewards, many assets available, and the ability to shop globally make it interesting. I remember when I first heard about the Nexo Card; I was sceptical of how a crypto card could improve my spending experience. But it piqued my curiosity, and I finally made a move and applied. Now I can’t wait to share my experience with you. But as one of the most famous crypto credit cards, is it truly the game-changer it claims to be? Let’s break down its features, fees and unique benefits to see if it lives up to its reputation.

Nexo Card in a nutshell

Not a fan of long reviews? Here’s the short version!

The Nexo Card is more than just a regular credit card; it’s really a crypto credit card. You can earn cashback as you spend, and you get to use it globally where Mastercard is accepted. The card links right to your Nexo account, allowing you to manage your crypto super easily. Imagine walking through your local market and buying organic fruits with Bitcoin you bought months ago without needing to convert it to fiat. That’s the beauty of the Nexo Card. I often think about how this card might drastically change everyday spending, and it truly does!

This card is designed to appeal to a wide audience, including crypto enthusiasts, new investors, and anyone curious about digital currencies. It helps bridge the gap between traditional finance and the crypto ecosystem, where crypto is no longer just an investment; it’s a means of transaction. My first shopping experience using the Nexo Card was eye-opening—paying with digital currency felt like participating in the future of finance.

📌 5 key takeaways:

- Crypto Credit Line: Use your crypto as collateral without selling it.

- No Minimum Repayments: Pay off what you use on your own schedule.

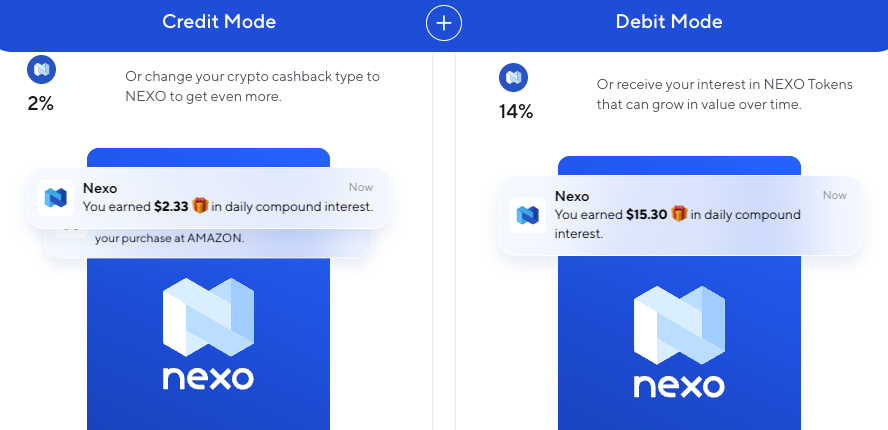

- Up to 2% Cashback: Earn rewards on every purchase, with options for BTC or Nexo tokens.

- No Monthly Fees: Enjoy the card with zero hidden costs or ongoing fees.

- Worldwide Acceptance: Spend anywhere that accepts Mastercard, from physical stores to online shopping.

What is the Nexo Card?

The Nexo Card is an offering from Nexo, a platform that focuses on cryptocurrency services, which cover lending, borrowing, and earning interest on digital assets. When you hold cryptocurrencies, the conventional thinking often says that selling them is necessary for spending. The Nexo Card shifts this paradigm. People can use the card to pay without converting their cryptocurrencies into cash, greatly improving the user experience.

Imagine this: You’ve held a large amount of Bitcoin for years, watching the price rise and fall. The last thing on your mind is wanting to sell it for something trivial, like a cup of coffee or even a new pair of shoes. The Nexo Card enables you to use your holdings as collateral for spending, giving you the liquidity you need without sacrificing the potential growth of your assets.

Many users, including myself, felt empowered when first using this card. Instead of being tied to restrictive banking practices, we suddenly had options to utilize our cryptocurrencies just like fiat money. The Nexo Card represents a bridge, connecting traditional finance with the crypto ecosystem. It symbolizes an evolution in how we engage with money.

📌 Related content you will love!

👉 How crypto cards work in 2024? 🧐

How does the Nexo Card work?

Using the Nexo Card is straightforward. First, you create a Nexo account, where you can deposit money, whether in fiat or crypto. Then when you want to spend, the card does all the heavy lifting. It figures out how much collateral you need to spend your crypto. For instance, let’s say you have $1,000 worth of Bitcoin, and you want to buy a nice dinner for $50. The Nexo system quickly processes this, allowing you to utilize the necessary amount of your Bitcoin for that transaction while retaining the rest.

One of the leading features of the card is the way it manages volatility. We all know how unpredictable crypto prices can be—intense market swings happen all the time! Imagine you’re planning a trip and need to convert your Bitcoin to cover hotels or meals, only to see its price skyrocket the following week. With Nexo, the risk of losing out due to price drops is minimized. Just recently, a friend of mine sold some Bitcoin to buy a guitar only to see the price surge the following week. Now, with the Nexo Card, he could have kept his Bitcoin and still bought his dream guitar.

The card also allows for easy repayment. After a user spends using the Nexo Card, the corresponding crypto amount is locked as collateral. Once the user repays the amount used (plus any applicable interest), the collateral is released back into their account, allowing them to retain ownership of their crypto. This cycle of spending and repaying further improves the flexibility of the card.

👉 Check out $NEXO on CoinMarketCap 🔗

Nexo card is awesome, what about the competition?

While the Nexo Card is great, you should also look at some alternatives on the market. Other crypto cards like Crypto.com, Binance Card, and Coinbase Card have their perks, too. Each of these cards has unique benefits targeted at specific audiences. For example, my friend Chloe loves her Crypto.com card primarily for its rewards program, which offers discounts and cashback on different levels of spending. However, she often has to go through the additional step of converting her crypto to fiat before making purchases. For her, that conversion felt like a lot of work compared to how effortlessly I could make transactions with my Nexo Card.

In fact, I recall a trip we took together to a local festival where food trucks didn’t accept cards—only cash. When Penny’s electrical card didn’t work at one stand due to conversion issues, I was able to use my Nexo Card without any stress. That incident opened her eyes to how the Nexo experience could streamline transactions in everyday situations.

A comparison of the features that various cards offer can help you make the right decision. For example, Crypto.com may provide greater incentives for spending or for maintaining tokens, while Binance focuses on trading features and benefits aligned with their exchange. So, when you’re choosing a card, it’s so important to determine your lifestyle, spending habits, and financial goals to select the one that suits you best. Sometimes it feels like shopping for a new phone; you want to find the one that fits perfectly while offering the best features for your needs.

Comparing Nexo Cards levels and their benefits

Nexo offers different levels, or tiers, that can be achieved based on how much Nexo Token (NEXO) you hold in your account. The higher your holdings, the more advantages you enjoy, such as increased cashback rates and enhanced features. Here’s how it breaks down:

- Base Tier: You earn 0.5% cashback on purchases. Most users start here, and it’s a straightforward introduction to Nexo’s services.

- Intermediate Tier: At this level, you earn 1% cashback. More NEXO holdings push users into this tier, and as a result, they get their rewards quickly.

- Premium Tier: This tier gives you 2% cashback on spending, and it is restricted to those with a good amount of NEXO holdings. My friends who reached this level were very happy, and I heard them talk about how excited they were when they got their cashback rewards.

Tiers also come with specific withdrawal limits and other perks that can significantly enhance how you utilize the card. For example, as I leveled up my tier, I noticed surprises in my cashback rewards each time I made purchases. It appeared to be a game, where your loyalty is fun.

I distinctly remember feeling quite proud when I qualified for the intermediate tier. My first experience with earning cashback felt like a small victory in personal finance, similar to finding an unexpected $10 note in an old pair of jeans. Watching my cashback build up created excitement and encouraged me to use my Nexo Card even more.

Nexo Card pros and cons

Pros

- No annual fees: A major plus for long-term cardholders

- Crypto-backed credit line: Borrow against your assets without selling them.

- Flexibility in repayments: No fixed monthly payments required.

- Easy access to funds: You can access funds easily and quickly. Knowing I could pull from my crypto whenever I needed was a game-changer for me.

- Earn rewards: People earn cashback with every purchase. Just the other day, I bought a snack at a café, where a little reward popped up in my app.

- Global acceptance: The card is accepted around the world. During my travels, I encountered vendors and shops without worrying about exchanging currency because I knew I’d have the option to use my card.

- Security features: Advanced security features keep your account secure. With two-factor authentication set up, I feel confident that my funds are safe. The assurance of having that safety net brings peace of mind.

- User-friendly interface: Navigating the Nexo app is simple. The design allows you to track spending easily, and making transactions is intuitive.

Cons

- Withdrawal fees: Some fees may apply for withdrawals. Usually, they’re small.

- Limited to Nexo’s ecosystem: You must hold and stake Nexo tokens to maximize rewards and benefits.

There’s certainly a learning curve to get your hands on the Nexo Card. It’s not uncommon to struggle a bit at first. When I first started, I found myself reaching out to the support team for clarification on a few features and their feedback was awesome.

Why is the Nexo Card so good?

Spend without selling

Being able to spend without selling your cryptocurrency is a remarkable benefit of the Nexo Card. Keeping your investments intact while enjoying your funds is ideal. It’s an exciting prospect! Recently, I wanted to buy a local artisan craft, but I hesitated because I didn’t want to convert my Bitcoin into cash for that purchase. The ability to utilize my assets without liquidating them is incredibly liberating. To go on a spontaneous shopping spree without worries is what many investors dream of.

Earn interest on holdings

An impressive aspect of using Nexo is how it allows you to continue earning interest on the cryptocurrency in your account. Essentially, it incentivizes holding onto your assets. The first time I saw interest accruing in my account was thrilling; it felt like I was finally making my money work for me.

Imagine using your Nexo Card to buy a nice dinner and then discovering a few days later that the money you spent earned you interest while sitting idle in the background! The allure of compounding interest made earning money effortless.

This feature not only encourages users to hold their investments but also creates an opportunity for generating additional earnings. The ability to gain interest while still being able to freely use the card is a standout aspect that is rarely seen in traditional banking.

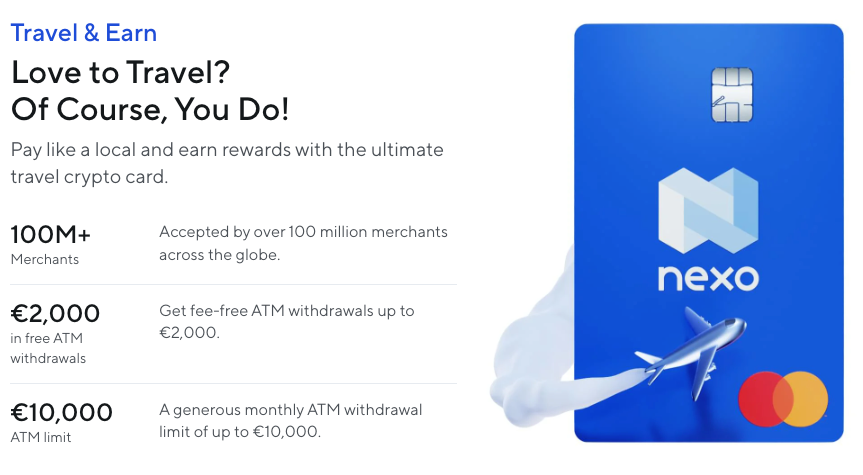

ATM Withdrawals

ATM access with the Nexo Card is so easy. It allows users to take cash out whenever needed, which is refreshing compared to how some other cards operate. I recall being on a weekend trip with friends when we needed cash to buy a group meal. They had forgotten to bring enough money, but I casually stopped at an ATM, used my Nexo Card, and pulled out cash. Everyone was relieved, and I felt heroic for that moment!

ATM access around the world means you can travel with peace of mind, knowing that you can access your funds regardless of where you are. It adds a layer of convenience that many of us have come to expect, especially while exploring new places.

What are Nexo Card limitations?

FIATx

Occasionally, Nexo employs something called FIATx. While it’s intended to help spending, for new users, it can be tough to understand. Initially, I stumbled through my understanding while my friend faced a similar situation, often missing many of the intricacies. Over time, as I engaged with tutorials and demos provided through Nexo, I harnessed the power of FIATx, allowing me to use my holdings without a hitch.

Money transfers

You might find that money transfers through Nexo can take some time. If you’ve become accustomed to instant transactions with your regular banking, the slower pace might be a bit frustrating. On one occasion, I needed to transfer cash urgently for an impending repair. It took much longer than I anticipated, which made planning ahead essential.

Base user free withdrawals

As a base user, you may find limitations on free withdrawals. Those fees can catch you off guard if you aren’t prepared. I distinctly remember receiving an unexpected withdrawal charge shortly after signing up, which prompted me to reconsider my spending strategies in the future.

Nexo card fees and rates review

Transaction fees

While using the Nexo Card is exciting, it’s important to be aware of any associated fees. Unexpected costs can creep up, especially when users are not familiar with the terms and conditions. Learning about these transaction fees can sometimes create a shock, especially if you are used to services that don’t impose similar costs.

Withdrawal fees

It’s vital to monitor withdrawal fees, which can vary based on your tier. If you’re a frequent drawee from ATMs, these fees can accumulate quickly! I discovered firsthand that strategic planning—like knowing when I would need cash and organizing my withdrawals appropriately—can save a lot of money over time.

Fees overall

When you dive into comparing fees across crypto card options, Nexo remains competitive. Being diligent about researching features and examining fee structures before binding yourself to a card is essential. Just as one might compare prices and features before making a big purchase, card users should approach this choice similarly.

Nexo Card limits

Keep an eye on spending limits based on your tier. You’ll find that base users typically face lower limits than premium users, who enjoy greater freedom and access. The gradual lift in transaction limits as I climbed the tiers felt like a tangible reward for my patience and commitment to the platform.

I was pleasantly surprised to discover that as I reached the premium tier, my transaction limits nearly doubled. I finally felt free to explore my spending without feeling held back by unnecessary restrictions.

Nexo Card cashback

Cashback rewards are hands-down one of the most exciting aspects of the Nexo Card. Every time I swipe my card, I earn a little bonus. Depending on your tier, you can earn between 0.5% and 2% cashback, which is a great incentive for sticking with the platform.

This cashback often feels like finding a little surprise gift every month—or even every time I used my card. I vividly remember the first time I redeemed cashback. It wasn’t a large amount, but it was enough to cover my favorite coffee order. Those little bonuses added up, extending the budget for non-essential purchases that brought me joy.

Nexo Card withdrawal

The Nexo Card simplifies the process of withdrawing cash. With widespread acceptance at ATMs, it allows users to access funds easily without dealing with multiple fiat conversions. Knowing your withdrawal limits helps figure out how to avoid any unpleasant fees—definitely a learning experience for me!

I recall novelty in seeing how easily I could withdraw cash in various locations, enabling much-needed access to cash on trips. It recognized cryptocurrencies as an approachable solution to an everyday problem that many users face.

Nexo Card supported cryptocurrencies

The flexibility of the Nexo Card is a significant draw, supporting many popular cryptocurrencies like Bitcoin and Ethereum. If you use different cryptocurrencies, it opens up a wide range of options. On several occasions, I utilized both Bitcoin and Ethereum balances for purchases based on market fluctuations. The ease of accessing my various holdings made financial management less of a chore.

Nexo card global acceptance

The Nexo Card’s acceptance worldwide provides excellent convenience and peace of mind. Shopping during my travels no longer posed a challenge; I could seamlessly make purchases without the hassle of currency conversions. I’d often reminisce about my previous travel troubles when dealing with multiple currencies and conversion fees. Now, the ease provided by the Nexo Card is a huge relief.

Nexo Card security and reliability

Account safety

With Nexo, security is a top priority. Advanced features like two-factor authentication ensure user funds remain secure. Establishing these precautions gives peace of mind, eliminating many jitters users might feel when navigating the digital financial landscape.

Practicing smart financial behavior is crucial nowadays, which is why having an app with robust security features means so much. When I activated 2FA, it felt like I was securing a personal vault filled with my assets, and deterrents against unwanted access.

What about hackers?

Up to now, Nexo has maintained a solid security record with no substantial breaches reported. However, it’s vital to stay alert and informed about updates or events affecting the global financial landscape and cryptocurrencies. Ongoing evaluations of users’ accounts help Nexo maintain a robust security framework that is reassuring for everyone.

Nexo Card: how it could be improved

Spend crypto

A critical area of improvement lies in enhancing the overall ease of spending crypto. The ultimate goal should be to streamline the process even further, allowing users to embrace the lifestyle without friction. The faster and simpler it becomes to use crypto for purchases, the more users will adopt it—this could be a revolutionary step for the card.

Expand support

Wider support for additional cryptocurrencies would be beneficial. Many users desire access to niche assets or unconventional tokens, which could expand Nexo’s user base. Conversations within my circle about the project were rife with excitement about new trends and developments; it illustrates how important it is for Nexo to keep up with emerging currencies.

How to top up your Nexo Card

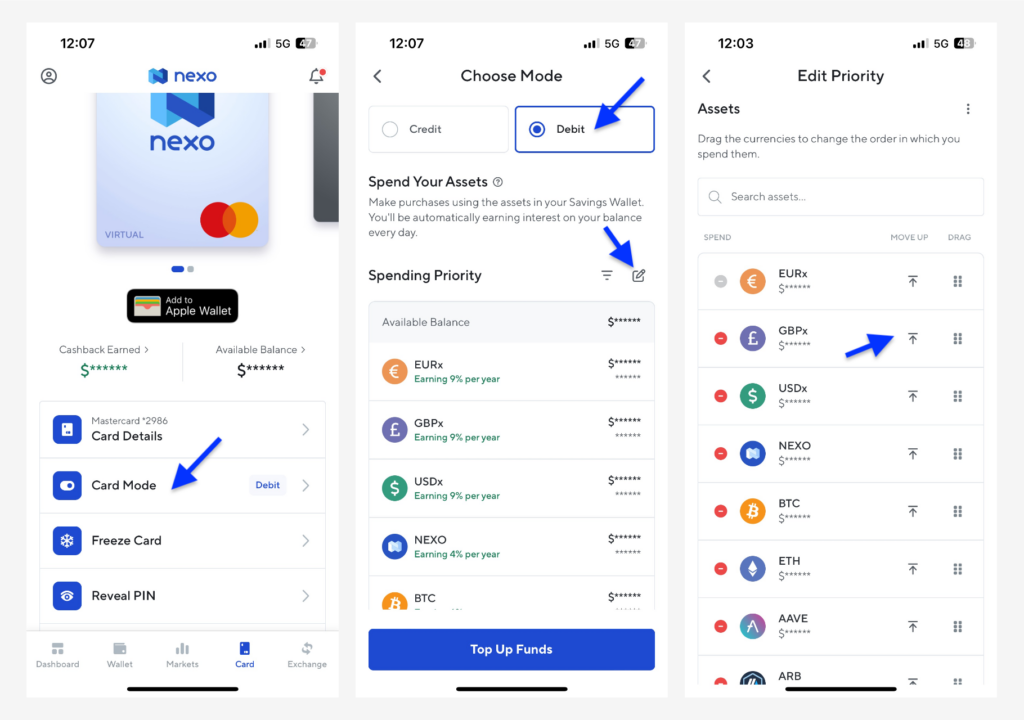

Top-Up debit mode

- Start by putting money into Nexo, either in crypto or fiat; the design is very user-friendly!

- Convert your balance into FIATx for easy spending.

- Move your balance into the FLEX term, which allows interest to accrue.

- Finally, switch to ‘Debit Mode’ to enjoy seamless transactions. It’s a streamlined process that has significantly benefited my finances during travel.

Top-Up credit mode

- Adding money to Nexo is the first step. It’s easy and straightforward.

- Ensure your assets tie to your credit line and keep your records clear.

- Use your Nexo card for spending wherever you need.

- Remember to pay off loans and interest to free your assets and enjoy a cycle of responsible management.

Is Nexo Card a good deal?

If you want straightforward spending with cryptocurrency, then yes, the Nexo Card might be an ideal fit. Earning cashback while keeping your assets safe feels like a significant win-win. I’ve utilized mine in plenty of situations, and I can confidently say it enhances everyday life and financial management.

The shift towards using crypto in everyday transactions is something I strongly believe in. It empowers consumers, fosters financial independence, and allows them to interact seamlessly with their investments. From eating out with friends to booking vacations, it feels terrific to have a card that supports my lifestyle while ultimately bringing in rewards.

Nexo Card Review FAQs

Here’s a deeper look into some common questions about the Nexo Card to give you a clearer understanding of what to expect:

Can a Nexo Card be used anywhere?

Absolutely! The Nexo Card works wherever Mastercard is accepted, which is fantastic. It provides versatility alongside cryptocurrency, effectively marrying digital real estate to the physical paper money world.

How do you withdraw money from a Nexo Card?

Simple! You can get cash at any ATM supporting Mastercard. I’ve taken out cash internationally with minimal hassle, which as a traveler, I appreciate immensely.

Can I use my Nexo Card at an ATM?

Sure! It can withdraw cash globally, and it’s super convenient! ATM access has never been easier for me now.

Is Nexo Card free?

Yes! There are generally no monthly fees, but do check for any transaction fees you might encounter, which can vary depending on usage.

Why use a Nexo Card?

This card allows spending without the hassles of selling your crypto. Plus, cashback rewards are an added perk that increases the card’s overall value.

What is the Nexo Wallet App?

The Nexo Wallet App makes managing your account seamless. Its user interface is designed for effectiveness, allowing smooth navigation.

Which Nexo Loyalty Tier is Best?

It really depends on your spending habits and investments. Higher tiers typically give better rewards but require an investment in NEXO holdings, making each individual’s choice unique.

How Do I Get a Nexo Card?

Obtaining a Nexo Card is straightforward; simply apply through their website or app. My experience of receiving it felt like gaining access to a new financial world.

How long does it take to get a Nexo Card?

After your application is approved, it generally shouldn’t take long—typically just a few weeks. The anticipation made the eventual arrival all the more exciting!

What is FIATx?

FIATx is a Nexo-specific digital currency designed to help transactions, allowing for user-friendliness and ease of conducting purchases within the framework.

How do you use the Nexo Card?

To use your card, simply load money into it and spend like a regular debit card. Having this ease at my fingertips changed my entire approach to spending.

Is Nexo trustworthy?

Overall, many users agree that Nexo is reliable, grounded in solid security measures while retaining an approachable interface for users, making it a trustworthy option.

Is the Nexo Card suitable for crypto newcomers?

Absolutely! The card is designed to be user-friendly and accessible for those entering the crypto world. It really lowers entry barriers.

How do Nexo cards compare to other crypto cards?

Nexo stands out for its cashback and the chance to earn interest on crypto assets, creating a unique selling proposition. Before finalizing your card choice, carefully compare features and fees.

Nexo Card explained in 2min in this Youtube video:

Final words on Nexo Card

Using the Nexo Card feels like opening a door to a new way of spending. The chance to spend cryptocurrency without selling it is so cool. I was amazed by how easy it was the first time I used it. It almost felt like I was part of something special, like the future of money was right in my hands. Every swipe felt like a small victory in my daily life. After hearing about the card, I decided to give it a try, and it’s been a great addition to my financial routine.

Cashback rewards are another little perk I never expected. Getting money back just for spending? What a great way to earn something extra while buying groceries or coffee! My friends were curious, and I told them how I earned rewards without even thinking about it. They were surprised when I shared how much I saved just by using the card regularly.

Security is super important for me too. I want to feel safe when using my money. The two-factor authentication feature gives me comfort. Knowing that my account has an extra layer of protection is like having a security guard for my cryptocurrency! I feel confident that my funds are secure and that I can access them whenever I need.

Even with the cool features, I think there are areas for improvement. Sometimes, I found myself wishing for more support for different cryptocurrencies. That would really make it stand out even more among other options.

This card connects with various platforms and gives me new opportunities to handle my finances better. It’s exciting to think about the possibilities ahead. As digital currencies continue to grow, having a Nexo Card makes me feel prepared for what’s next. My appetite for crypto grows with every transaction. I had a fantastic experience, and I believe many others will feel the same.

So, if you’re looking to bridge the gap between regular spending and cryptocurrency, the Nexo Card may fit just right. It’s been great to use my crypto in real-life situations. This card empowers me to take control of my finances while reaping rewards. Who wouldn’t want that? Embracing the Nexo Card has opened doors to a new way to manage wealth and enjoy everyday life! My journey’s just starting, and I can’t wait to see what happens next with my cryptocurrency journey. Enjoy your spending adventures!

📚 Similar content you might like:

👉 How crypto cards work in 2024? 🧐

👉 Holyheld review: the best non-custodial crypto card? 💳

📌 Never miss a new post! Follow us:

👉 Linkedin

👉 X (Twitter)

👉 Facebook

👉 This article is provided by Web3Lens, learn more about us here.