Cryptocurrency is quickly becoming a key part of financial portfolios worldwide. With a market value over $2 trillion, according to CoinMarketCap, it’s no surprise that banks and fintech startups are making it easier to use crypto in everyday transactions. One of the most exciting developments? Crypto credit cards.

But how do they actually work, and why should you care? Let’s break down the details, benefits, and potential drawbacks to help you decide if a crypto credit card is a good fit for you.

👉 Want to learn more? Head over to our guides 📚

What are crypto credit cards?

Crypto credit cards work much like regular rewards credit cards. The key difference? Instead of earning points, miles, or cashback, you’re rewarded with crypto. So, every time you swipe, you’re stacking up Bitcoin, Ethereum, or maybe even altcoins, depending on the card.

Wondering how that actually happens?

When you make a purchase, some crypto cards will convert your spend into points, which you can redeem for crypto later. Others just drop the crypto directly into your account.

For example:

- Bitrefill Card: This one lets you top up your balance using Bitcoin, Ethereum, and other cryptos. You don’t have to mess with points, just spend your crypto directly on gift cards and services from a variety of merchants.

- Holyheld Debit Card: With this card, you earn crypto cashback on every purchase. The crypto gets deposited into your wallet right away, so you can access it immediately, no need to wait for conversions.

Related content you will like!

👉 Bitrefill Gift Card Honest Review 2024 💙

How crypto credit cards differ from traditional credit cards

At first glance, crypto credit cards aren’t too different from your regular credit card. But the way rewards work is unique. While typical credit cards offer perks like cashback, points, or miles, crypto cards pay you in digital currency. The cool part? Your crypto rewards could potentially increase in value over time, unlike fixed-value rewards like miles.

Of course, crypto’s volatility is something to take into account. Sure, your Bitcoin rewards might grow one month, but they could also drop sharply the next. If you’re someone who prefers predictability, this is something to keep in mind.

There are also cards, like the Coinbase Debit Card, that let you make purchases straight from your crypto balance. Others, like Venmo Credit Card, automatically convert cashback into crypto.

Another thing to watch for is taxes. Unlike regular credit card rewards, which aren’t taxed, crypto rewards are treated like assets. If you sell or convert your crypto for a profit, you might need to pay taxes on those gains. Keeping track of your crypto transactions is essential, and working with a tax professional is a smart idea to avoid headaches later.

Things to consider before getting a crypto credit card

Crypto credit cards sound exciting, but there are a few important things to think about before signing up:

Tax implications

Crypto rewards are taxable if you sell or convert them. The more crypto you earn, the more complicated your tax situation gets. It’s worth speaking with a tax pro if you plan to rack up a lot of crypto rewards.

Flexibility with crypto options

Not all crypto cards offer the same range of cryptocurrencies. Some only reward you with a few coins, while others let you choose from a wider variety. If you’re set on earning a specific coin, make sure the card supports it.

Fewer perks compared to traditional cards

Earning crypto is fun, but many crypto credit cards don’t offer the same extra benefits as top-tier travel or cashback cards. For example, a Chase Sapphire Reserve gives you travel credits and lounge access, perks that some crypto cards lack for now.

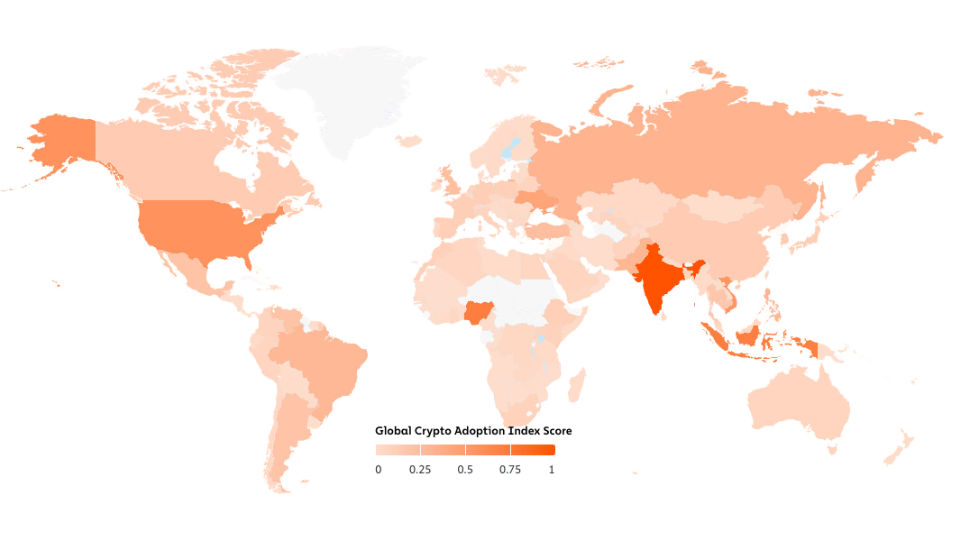

Geographic limitations

Crypto cards aren’t available everywhere. Depending on your location, state or country regulations might prevent you from getting the card you want. Always check the availability in your area before applying.

Conclusion: Is a crypto credit card right for you?

Crypto credit cards open up a whole new way to diversify your rewards. Instead of traditional perks, you’re earning cryptocurrency with each purchase. But keep in mind, there’s a lot of volatility involved, along with potential tax obligations.

👉 Wondering how you could refill your crypto card? Learn how you can make profit with memecoins using Moonshot on Solana!

If you’re already into crypto and can handle the ups and downs, a crypto card could be a cool addition to your wallet. But if you prefer stability and predictable rewards, a traditional card might be more your speed.

Remember, no matter which path you choose, always use credit responsibly and make decisions that align with your financial goals. If you’re more of the type to have visual memory, then watch this video:

📚 Similar content you might like:

👉 How to buy e gift cards online instantly 🎁

👉 Nexo Card Review: The game-changer? 💎

👉 Gnosis Pay Review : A Crypto Card Built for You, Powered by Visa 💚

👉 Holyheld review: the best non-custodial crypto card? 💳

📌 Never miss a new post! Follow us:

👉 Linkedin

👉 X (Twitter)

👉 Facebook

👉 This article is provided by Web3Lens, learn more about us here.