TL;DR: Learn how to put your Bitcoin to work through Bedrock’s liquid staking protocol, earn multiple rewards streams and participate in the growing BitcoinFi ecosystem.

Introduction

For years, Bitcoin holders have faced a classic dilemma: hold onto their BTC for long-term appreciation or sell it to unlock liquidity. This choice has often left many in a bind—either sacrificing the potential future gains of Bitcoin’s price or missing out on opportunities to earn yield from other financial instruments. As a result, Bitcoin has remained largely static in many portfolios, with holders focusing solely on price appreciation without leveraging its potential for additional financial growth.

What is Bedrock?

Enter Bedrock, a game-changing protocol that is reshaping the landscape of Bitcoin yield generation. With Bedrock’s innovative non-custodial liquid staking solution, Bitcoin holders no longer have to make that difficult choice. The platform enables users to maintain full exposure to Bitcoin’s price while simultaneously earning additional rewards through staking and liquidity provision. Bedrock opens the door to a new way of thinking about Bitcoin, not just as a store of value but as a dynamic, yield-generating asset within the decentralized finance ecosystem.

When you’re staking your Bitcoin through Bedrock, you gain access to a range of DeFi tools that allow you to earn passive income, participate in high-yield farming opportunities, and even borrow against your Bitcoin without relinquishing control of your assets. This transforms Bitcoin from a purely speculative asset into a productive, income-generating investment, all while maintaining its core appeal as a decentralized, secure, and valuable cryptocurrency.

Bedrock is a multi-asset liquid staking protocol backed by industry leaders like OKX Ventures, Amber Group, and LongHash Ventures. Developed in partnership with RockX, it introduces uniBTC – a non-rebasing token that represents your staked Bitcoin plus all future staking rewards.

Key Features:

- Non-custodial solution

- Universal (uni) standard for maximum liquidity

- Multiple reward streams

- Cross-chain compatibility (11 networks)

- 25+ DeFi integrations

Quick Guide to get Started with Bedrock

Step 1: Preparing Your Bitcoin

Before you begin, you’ll need Bitcoin in a form that can be staked. You have several options:

- Native BTC

- Wrapped BTC (wBTC)

- Bridged BTC from other chains

Step 2: Connecting to Bedrock

- Visit Bedrock here.

- Connect your Web3 wallet

- Make sure you have enough ETH/native tokens for gas fees

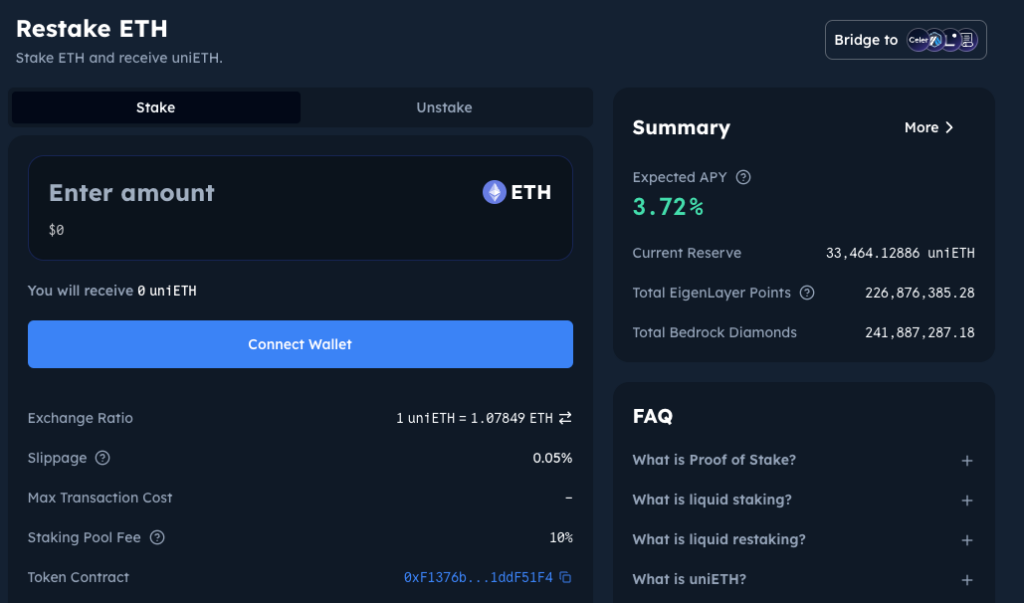

Step 3: Staking Your Bitcoin

- Select the amount of BTC you want to stake

- Approve the token spend (if using wBTC)

- Confirm the transaction

- Receive uniBTC tokens representing your stake

Note: uniBTC is non-rebasing, meaning your token count stays the same while the value per token increases over time.

Understanding Your Rewards

When you stake with Bedrock, you earn multiple reward streams:

- Staking Rewards

- Native blockchain rewards

- Automatically reflected in uniBTC value

- Babylon Points

- Currently leading with 5,854 points per BTC

- Used for future governance and potential airdrops

- Bedrock Diamonds

- Platform-specific rewards

- Special multipliers during campaigns (up to 42x)

- EigenLayer Points

- Additional layer of rewards

- Part of the broader restaking ecosystem

Special Campaign: Arbitrum Bitcoin Uprising

Duration: October 7, 2024 – January 7, 2025

Bedrock has rolled out an exciting rewards campaign, offering participants the chance to earn valuable tokens and points.

Rewards Breakdown

- 150,000 ARB Tokens

Participants in the campaign can earn a share of 150,000 ARB tokens, which are distributed based on their contribution to liquidity and overall participation. ARB, being the native governance token of Arbitrum, adds a significant incentive for users looking to expand their holdings in the Arbitrum ecosystem. - Babylon Points

Babylon Points serve as additional rewards for users who contribute liquidity to the campaign. These points can often be exchanged for future benefits, such as exclusive access to platform features or additional staking opportunities. They also help participants increase their standing in the Bedrock ecosystem. - 42x Bedrock Diamonds Multiplier

The “42x Bedrock Diamonds multiplier” offers a significant boost to users’ rewards. By participating in the campaign, users can enjoy this massive multiplier on their liquidity rewards, exponentially increasing their earnings. This multiplier is designed to incentivize early and consistent participation.

Here’s a step-by-step guide to get started and maximize your rewards:

1. Mint uniBTC or Acquire It Through Decentralized Exchanges

To participate, you’ll first need to hold uniBTC, which is a liquid staking token that represents Bitcoin staked on Bedrock. You have two options to acquire uniBTC:

- Mint uniBTC: If you already hold Bitcoin, you can mint uniBTC directly by staking your BTC in Bedrock’s liquid staking protocol. This will give you uniBTC in return, allowing you to use it for liquidity provision.

- Acquire through DEXs: Alternatively, you can purchase uniBTC on various decentralized exchanges (DEXs) like Uniswap or SushiSwap. By doing this, you bypass the need to stake Bitcoin directly and can move on to the next steps more quickly.

2. Add Liquidity to Approved Pools

Once you have uniBTC, the next step is to provide liquidity. Bedrock has partnered with several decentralized exchanges where you can contribute to liquidity pools approved for this campaign. These pools often pair uniBTC with other assets (like ETH or stablecoins), allowing you to contribute liquidity by depositing your tokens.

- To add liquidity, simply visit the platform hosting the approved pools (e.g., Uniswap, SushiSwap), navigate to the liquidity section, and add uniBTC and the corresponding asset into the pool.

- Ensure you’re adding liquidity to the approved pools listed by Bedrock to qualify for the campaign rewards.

3. Maintain Your Position During the Campaign

To maximize your rewards, it’s crucial to keep your liquidity position active throughout the entire campaign duration. By maintaining your position, you ensure eligibility for rewards such as ARB tokens, Babylon Points, and the Bedrock Diamonds multiplier.

- If you remove liquidity before the campaign ends, you may forfeit your share of rewards. Therefore, make sure your assets remain staked for the full duration to collect maximum rewards.

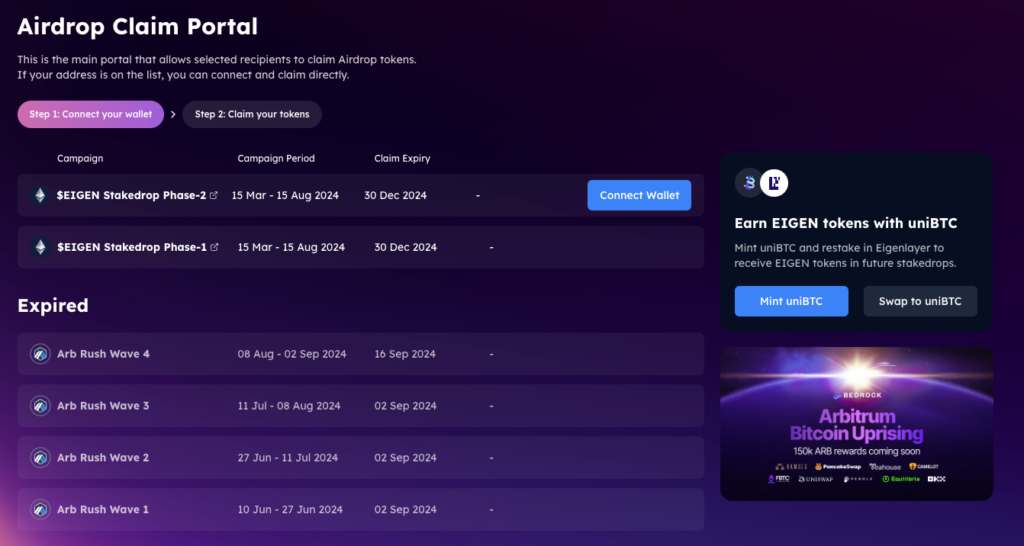

4. Claim Rewards Through the Hedge Platform

Once the campaign is complete, you can claim your rewards through Bedrock’s partner platform, Hedge. Here’s how:

- Navigate to Hedge: After the campaign ends, head over to the Hedge platform.

- Connect Your Wallet: Make sure to connect the same wallet you used to participate in the campaign. This allows the system to verify your contributions and calculate your rewards.

- Claim Your Rewards: On the platform, you’ll be able to see your share of ARB tokens, Babylon Points, and any applicable multipliers. Simply click the claim button to have your rewards transferred to your wallet.

Get Your Rewards

To get the most out of the Bedrock campaign, consider the following tips:

- Enter Early: Rewards may be distributed based on the amount of time you’ve provided liquidity, so entering the campaign early can help you secure a larger share.

- Choose Pools Wisely: Make sure you’re adding liquidity to the pools that offer the highest rewards or multipliers to optimize your potential earnings.

- Monitor Campaign Updates: Bedrock might release new updates or strategies to further boost your earnings, so stay informed through their official channels.

Maximizing Your Yields: The DeFi Integration Guide

For users looking to get the most out of their Bitcoin holdings through Bedrock’s DeFi ecosystem, there are multiple avenues to explore. Whether you want to provide liquidity, yield farm, or lend, the Bedrock platform offers several high-reward opportunities that allow you to maintain exposure to Bitcoin while optimizing your yield generation. Let’s dive deeper into the three primary options available to maximize your returns.

Option 1: Liquidity Provision

One of the most straightforward and effective ways to generate yield is by providing liquidity to approved pools. By adding your assets, such as uniBTC, to these liquidity pools, you not only facilitate decentralized trading but also earn attractive annual percentage yields on your deposited tokens. The Bedrock ecosystem has strategically partnered with some of the top decentralized exchanges to offer competitive APYs, along with bonus rewards in the form of Babylon Points and Bedrock Diamonds multipliers.

Here are the top pools currently offering the best APYs:

- Camelot Pool

- APY: 17.42%

- Rewards: Along with a lucrative 17.42% APY, liquidity providers earn 1x Babylon Points and a 42x Bedrock Diamonds multiplier. Babylon Points are Bedrock’s ecosystem rewards points, while the Bedrock Diamonds multiplier amplifies the rewards from staking or liquidity provision.

- Why Choose Camelot: Camelot is known for its strong liquidity and user-friendly interface, making it a preferred choice for both new and seasoned DeFi users.

- Ramses Pool

- APY: 15.60%

- Rewards: Providers in this pool also earn 1x Babylon Points, the 42x Bedrock Diamonds multiplier, and, additionally, RAM Points, which are specific to the Ramses protocol and offer further bonus incentives.

- Why Choose Ramses: Ramses offers slightly lower APY compared to Camelot but provides additional rewards in the form of RAM Points, making it a compelling option for those who want to diversify their reward streams.

Providing liquidity in these pools allows you to earn passive income on your holdings while maintaining exposure to Bitcoin through uniBTC. The combination of APYs and bonus rewards makes this an excellent choice for users seeking high, consistent returns.

Option 2: Yield Farming

Yield farming takes your DeFi participation to the next level by maximizing returns through a strategy of staking or lending tokens on various DeFi platforms. Bedrock_DEFI has partnered with several yield farming platforms where you can deposit your assets and farm additional rewards. This strategy allows for higher yields compared to basic liquidity provision, as yield farming often involves stacking multiple layers of incentives.

Here are the recommended platforms for yield farming in the Bedrock ecosystem:

- Pendle

Pendle is a decentralized yield trading protocol that allows you to tokenize and trade future yield. By using Pendle, you can deposit your uniBTC and not only earn a return on your assets but also have the opportunity to trade the future yield, thus creating a dynamic yield farming environment.

Referral Link: Pendle - Spectra

Spectra offers yield farming opportunities with a focus on sustainable returns. Through this platform, you can farm additional rewards by staking your uniBTC or liquidity pool (LP) tokens. Spectra has a growing reputation for security and steady returns, making it a solid option for yield farmers looking to optimize their gains without exposing themselves to unnecessary risk.

Referral Link: Spectra - Equilibria (Coming Soon)

Bedrock’s upcoming partnership with Equilibria will introduce even more yield farming options for uniBTC holders. This platform is expected to offer unique yield farming pools with added incentives for early participants. Stay tuned for its launch as it will provide yet another way to maximize your yield through the Bedrock ecosystem.

Yield farming, especially through platforms like Pendle and Spectra, allows for compounded returns and greater exposure to the DeFi market’s inherent flexibility. By leveraging Bedrock’s integration with these platforms, you can ensure that your uniBTC works even harder for you, continuously generating rewards.

Option 3: Lending

Another option for users who want to maximize their yields without selling their uniBTC is through lending. Lending platforms that support uniBTC as collateral allow you to maintain your exposure to Bitcoin’s price movements while using your staked BTC to access additional liquidity.

How It Works:

By using uniBTC as collateral, you can borrow other assets—such as stablecoins or ETH—without having to sell your Bitcoin. This strategy is particularly effective in bull markets when you anticipate a rise in BTC’s value but need liquidity for other investments or expenses. With Bedrock’s lending integrations, you can borrow against your uniBTC holdings, giving you the flexibility to deploy capital elsewhere in DeFi without losing your Bitcoin exposure.

Benefits of Lending uniBTC:

- Maintain BTC Exposure: You continue to benefit from any price appreciation of Bitcoin while still utilizing the value of your uniBTC.

- Leverage Without Selling: Lending allows you to leverage your BTC position without incurring taxable events or missing out on future price increases.

- Earn While Borrowing: In some cases, you can even earn yield on the borrowed assets or the collateral itself, further enhancing your returns.

Bedrock’s growing ecosystem will soon offer more options for users to borrow against uniBTC on a variety of lending platforms, providing even more flexibility in how you can utilize your assets.

Security Considerations

Bedrock provides the highest level of security for its users by using a combination of decentralized infrastructure, partnerships with industry-leading providers and a non-custodial framework. Let’s break down the core pillars of Bedrock’s security approach:

1. Distribution Across Multiple Finality Providers

Finality providers play a critical role in securing transactions and finalizing them within the network. Bedrock’s unique approach distributes responsibilities across multiple trusted providers, reducing the risk of single points of failure and enhancing the overall stability of the protocol. By spreading finality validation across several entities, Bedrock ensures that no one provider has control over the network, making it more resilient to potential threats.

2. Non-Custodial Architecture

At the heart of Bedrock’s security strategy is its non-custodial nature. Users retain full control over their assets throughout the staking process, eliminating the need to trust third parties with their holdings. This design minimizes risks, as funds are never stored in a centralized location vulnerable to hacking or misuse. Instead, Bedrock’s architecture ensures that users always have access to their staked assets and can withdraw them at any time, providing peace of mind.

3. Partnership with Established Infrastructure Providers

Bedrock has strategically partnered with some of the most reliable and trusted infrastructure providers in the DeFi space to further strengthen its protocol. These partnerships ensure that the platform operates on a secure and scalable foundation, allowing for seamless staking experiences across multiple asset classes. By aligning with established names, Bedrock enhances the overall security and reliability of its service.

4. Regular Audits and Security Reviews

To maintain high-security standards, Bedrock undergoes regular audits and security reviews from reputable third-party firms. These ongoing assessments ensure that any vulnerabilities are quickly identified and addressed, keeping the protocol secure against emerging threats. Users can stake their assets with confidence, knowing that Bedrock continually prioritizes security through rigorous testing and monitoring.

Who are Bedrock’s Finality Providers?

To further solidify its security approach, Bedrock has enlisted the services of several leading finality providers. These include:

- Infstones: A top-tier infrastructure provider known for its high performance and reliability.

- B2: A trusted name in DeFi infrastructure, offering secure and scalable services.

- Spiderpool: A leading pool provider with a strong track record of securing decentralized networks.

- RockX: Bedrock’s strategic partner, providing robust infrastructure solutions that power the protocol’s operations.

By relying on such established names in the industry, Bedrock remains secure, reliable, and efficient. Bedrock users can earn yield on their assets with confidence.

Future Developments

The restaking landscape is still in its early stages, and Bedrock is uniquely positioned to tap into the vast potential of Bitcoin’s market. With Bitcoin boasting a staggering $1.2 trillion market cap, the current amount of BTC restaked on the Babylon platform – only 22,891 BTC – represents a fraction of its true potential. As the adoption of restaking protocols grows, this number is expected to increase exponentially, especially as more users become aware of the benefits of staking their BTC without compromising security or exposure to price movements.

To put this into perspective, consider the success of other restaking protocols such as EigenLayer, which has already achieved a Total Value Locked (TVL) of $10.58 billion. This provides a strong indication of the massive growth that Bitcoin restaking could experience in the near future. Given Bitcoin’s dominant position in the cryptocurrency market and its role as the most trusted digital asset, the adoption of Bitcoin restaking could mirror – or even surpass – the levels seen with Ethereum and other staked assets.

Bedrock is perfectly aligned to take advantage of this growth trajectory by providing a secure, non-custodial, multi-asset liquid staking protocol that caters specifically to Bitcoin holders. As more users and institutions recognize the benefits of restaking their Bitcoin, Bedrock has the infrastructure and partnerships in place to accommodate large-scale adoption. The future of Bitcoin restaking is bright, and Bedrock stands ready to lead this emerging trend.

Conclusion

Bedrock represents a transformative leap in Bitcoin yield generation, allowing holders to unlock the full potential of their BTC holdings without sacrificing control or security. By offering a robust, non-custodial, and multi-asset liquid staking protocol, Bedrock enables users to convert static Bitcoin holdings into dynamic, yield-generating assets. This allows users to continue benefiting from BTC’s price appreciation while simultaneously earning additional rewards.

Through its innovative security measures, including the distribution of finality providers and strategic partnerships, Bedrock provides a trusted and scalable solution for Bitcoin restaking. Additionally, the significant reward potential, including ARB tokens, Babylon Points, and Bedrock Diamonds multipliers, makes participation in the Bedrock ecosystem even more attractive.

By following this guide and staying active in the Bedrock ecosystem, users can maximize their participation in one of the most promising developments in the DeFi space. Whether you’re a seasoned Bitcoin holder or a newcomer to DeFi, Bedrock offers a secure and rewarding opportunity to grow your portfolio, all while maintaining exposure to Bitcoin’s price action.

As the restaking market continues to evolve, Bedrock is poised to lead the way, driving innovation and offering new ways for Bitcoin holders to capitalize on their investments. Now is the time to get involved and be part of the future of Bitcoin yield generation with Bedrock.

📚 Similar content you might like:

👉 Berachain Airdrop guide : Earn $BERA crypto 🧸

👉 Solana Sonic Game Coin: Airdrop guide 🪂

👉 How to make big profits with memecoins using Moonshot on Solana ? 🚀

📌 Never miss a new post! Follow us:

👉 Linkedin

👉 X (Twitter)

👉 Facebook

👉 This article is provided by Web3Lens, learn more about us here.