Let’s talk about making the most of those wild memecoin tokens, and not just when prices are shooting for the moon! While everyone loves watching their favorite token pump, smart traders know there’s potential profit in both directions. If the market’s rising or diving, we’ll break down how you can use leverage to potentially maximize your trading game.

Think about it – some of these memecoins have grown into serious players in the crypto world. And with leverage trading, you don’t need a massive wallet to get in on the action. But heads up: we’re not talking about throwing money at random coins and hoping for the best. This is about understanding the tools at your disposal and using them smartly.

In this guide, we’ll cover:

- How to spot good memecoins trading opportunities

- Using leverage without getting rekt

- Playing both sides of the market

- Keeping your trading strategy solid when things get crazy

If you’re ready to level up your trading game, let’s explain how you can potentially make those meme coin moves work for you, whether the market’s hot or not.

Why Choose Leverage When Trading Meme Coins?

Leverage is a powerful tool that allows you to increase your trading power significantly. Imagine you’re working with a capital of $1,000. By applying 5x leverage, you’re effectively trading as if you have $5,000 at your disposal. This means that any profits you make can be magnified, enabling you to achieve higher returns on your investments in a shorter time frame. However, it’s crucial to understand that while leverage can increase your potential profits, it also comes with more risks. If the market moves against your position, your losses can be amplified just as much as your gains.

That’s why managing your risk is essential, especially when dealing with the volatile nature of memecoins, which can experience rapid price swings within short periods.

Leverage can be tricky; it’s essential to approach it with caution and a well-defined strategy. It allows traders to enter larger positions than they could afford with their own capital alone, creating opportunities to capitalize on smaller price movements. However, you must have a solid understanding of market trends and the specific memecoins you’re trading. Developing a strategy that incorporates proper risk management and market analysis will help you navigate the challenges of leveraged trading effectively and let you maximise gains while minimising potential losses.

Where to Trade memecoins with Leverage

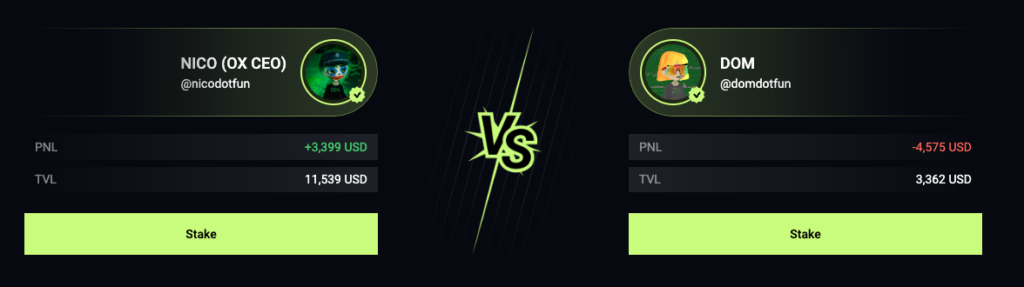

To trade memecoins with leverage effectively, you need to find a platform that supports memecoins, which is rare. One such option is OX.FUN, which has a selection of memecoins for trading, including many that are not listed on other exchanges. This platform has led to the growing interest in memecoins by providing traders with a trading experience perfect for their needs.

OX.FUN not only features popular coins but also supports memecoins that are less known, giving you the chance to explore new opportunities. If you’re interested in trading Solana-based memecoins like GIGA, MOG, or MOODENG, OX.FUN has up to 5x leverage for both long and short positions. You can therefore increase your trading potential significantly. The flexibility can be a game-changer for traders looking to maximize their exposure in the memecoin market.

To get started, you’ll need to connect your wallet (such as Phantom) to the OX.FUN platform and deposit funds. With a large selection of memecoins and the option to use leverage, OX.FUN positions itself as a perfect platform if you’re looking to explore the strategy of meme coin trading.

Step-by-Step Guide to Placing a Leveraged Trade

Placing a leveraged trade can seem complicated, but breaking it down into clear steps can make the process more manageable. Here’s a detailed guide to executing a leveraged trade successfully:

- Select Your Coin: Start by choosing the specific meme coin you want to trade. For example, let’s assume you’ve decided to short $GIGA based on your market analysis and expectations about its future price movement.

- Choose Your Leverage: Next, determine the level of leverage you wish to apply to your trade. If you select 5x leverage, this means that every 1% movement in price will impact your trade as if it moved 5%. This leverage allows you to take advantage of smaller price fluctuations, but it also means that you need to be more vigilant about market movements.

- Allocate Funds: Decide how much of your total capital you want to allocate for this trade. For instance, if you have $1,000 available, you might choose to allocate 50% of your funds ($500) to this short position. This decision should be based on your overall trading strategy and risk tolerance.

- Place Your Order: Finally, you can place your trade. You have the option to set a limit order, which will execute at a specific price, or a market order, which will execute immediately at the current market price. Once your order is placed, your leveraged position will be active, and you’ll be positioned to profit from the price movements of the selected meme coin.

Long vs. Short: Making the Right Choice

Understanding when to go long or short is crucial for trading memecoins effectively:

- Going Long: When you anticipate that a coin’s price will rise, you take a long position. For example, if you believe that MOG is set to experience an upward trend, entering a long trade allows you to profit as the price increases. This strategy works well when market sentiment is positive, and you have confidence in the coin’s future performance based on your analysis.

- Going Short: Conversely, if you expect a coin’s price to decline, you’ll take a short position. In the earlier example with $GIGA, you’re betting that its price will fall, enabling you to profit as it decreases. Shorting can be a useful strategy during bearish market conditions or when specific market indicators suggest a downturn is imminent.

Both strategies offer opportunities to capitalize on market movements, but it’s essential to remember that leverage amplifies both gains and losses. An understanding of market trends and sentiment will significantly improve your chances of success, so be prepared to adjust your strategy as needed.

Using On-Chain Data for your Trading Strategy

Using on-chain data is an effective way to enhance your trading strategy. On-chain data provides insights into the activities of major investors, often referred to as “smart money.” By tracking their buying and selling patterns, you can make more informed decisions regarding which memecoins to long or short.

For instance, if you observe a significant influx of funds into a coin like $POPCAT, it may signal a potential long opportunity, indicating that large investors have confidence in its future growth. Conversely, a decline in net fund flow for $GIGA might suggest a favorable shorting opportunity, indicating weakening demand.

You need to think of this market like a chess game – watching what the big players are doing can give you important data. When major investors make their moves, it often signals upcoming trends. Keeping tabs on their activity can help you make more informed decisions about when to enter or exit trades.

Just remember that this is one tool in your trading toolkit, not the whole playbook. Markets shift quickly, especially in the memecoin ecosystem, so staying flexible with your strategy is key. Pay attention to the signals, analyze the patterns, but always be prepared to adapt when conditions change.

Success here often comes down to timing and awareness. Use the information at your disposal, but combine it with your own analysis before making any moves.

👉 How to Track Solana Wallets: Easy Guide [2024] 🔍

Using memecoins as Collateral

One of the big advantages of trading on platforms like OX.FUN is the ability to use memecoins as collateral. If you hold memecoins that you believe still have growth potential, you don’t have to liquidate them to engage in leveraged trades. Instead, you can deposit these coins as collateral, allowing you to trade with leverage while maintaining your asset holdings.

This flexibility is particularly beneficial for traders looking to capitalize on short-term trading opportunities without sacrificing their long-term investments. When you’re using memecoins as collateral, you can navigate the market more effectively and take advantage of price movements without losing your existing positions. With this strategy, you have a way to maximize trading potential and still retain exposure to coins you believe in.

👉 Can My Phantom Wallet Be Hacked? The Truth Every Solana User Needs to Know 💜

Monitoring Your Trades and Risk Management

Once you have placed a leveraged trade, monitoring your position becomes essential, especially when leveraging. Price movements in the market can be swift and unpredictable, and small fluctuations can have a significant impact on your profits or losses.

To protect your capital, make use of stop-loss and take-profit orders. For example, if you’re long on $GIGA at 10x leverage, you might set a take-profit order at a 10% increase in price and a stop-loss order at a 5% decrease. This ensures that your trade is automatically managed, allowing you to limit your losses and secure profits even if you’re not actively monitoring the market.

Implementing these risk management strategies is vital for preserving your capital and achieving long-term success in the meme coin market. With the right precautions, you can navigate the volatile landscape more effectively and improve your overall trading outcomes.

Transforming Small Investments into Significant Gains

Memecoins present a unique opportunity to convert a small initial investment into substantial profits. The inherent volatility of the market allows for rapid price changes, and when combined with leverage, you can significantly enhance your potential returns. However, it’s crucial to exercise caution and avoid excessive leverage, particularly with highly volatile memecoins, as the risks of significant losses can be substantial.

Trading memecoins can be exciting, especially when you’re eyeing those big potential returns. But let’s be real – having a solid plan is what separates smart trades from gambling. It’s about finding that sweet spot between taking calculated risks and protecting your capital.

👉 How to Trade Michi with Leverage: A Step by Step Guide 🚀

Smart trading isn’t just about spotting opportunities – it’s about knowing when to make your move and when to sit back. Take your time to understand what’s happening in the market, stick to your strategy, and don’t let FOMO drive your decisions.

Sure, trading memecoins can be profitable – but consistent success comes from being level-headed and strategic, not from chasing every pump. Keep your emotions in check, set clear limits, and you’ll be better positioned to handle whatever the market throws at you.

FAQ

1. What are meme coins?

Meme coins are cryptocurrencies that typically gain popularity due to internet memes or social media trends rather than any underlying technological advancement. Examples include Dogecoin and Shiba Inu, which have amassed large communities and speculative trading activity.

👉 How to make big profits with memecoins using Moonshot on Solana ? 🚀

2. How does leverage work in trading?

Leverage allows traders to borrow funds to increase their trading position size beyond what their own capital would allow. For example, using 5x leverage means you can trade five times your actual capital. While this can amplify profits, it can also amplify losses, making risk management crucial.

3. What platforms can I use to trade meme coins with leverage?

Platforms like OX.FUN provide a range of meme coins for trading with leverage. It’s essential to choose a reputable platform that offers the coins you’re interested in and provides a user-friendly interface for executing trades.

4. How do I manage risk when trading meme coins?

Risk management strategies include setting stop-loss orders, take-profit orders, and not investing more than you can afford to lose. Keeping a diversified portfolio and using only a portion of your capital for leveraged trades can also help mitigate risks.

5. Can I trade meme coins on centralized exchanges?

Yes, many centralized exchanges offer trading options for popular meme coins. However, not all exchanges provide leverage, so it’s essential to research which platforms support leveraged trading for specific meme coins you’re interested in.

6. What is the difference between going long and going short?

Going long means you anticipate that the price of a coin will increase, allowing you to profit as it rises. Conversely, going short involves betting that the price will decrease, enabling you to profit as it falls. Both strategies are important for leveraging market conditions effectively.

7. Are meme coins a good investment?

Meme coins can be highly volatile and speculative, making them a high-risk investment. While some investors have seen significant returns, others have incurred substantial losses. Conducting thorough research and understanding the market dynamics is crucial before investing.

8. How can on-chain data improve my trading strategy?

On-chain data provides insights into the activities of major investors and market trends. By analyzing this data, you can identify buying or selling pressure, track significant fund inflows or outflows, and make more informed decisions about which meme coins to trade.

9. What are the benefits of using meme coins as collateral for leveraged trading?

Using meme coins as collateral allows you to retain your asset holdings while still engaging in leveraged trades. This flexibility can help you capitalize on short-term trading opportunities without liquidating your positions in coins you believe have long-term potential.

10. What should I consider before using leverage in my trading strategy?

Before using leverage, consider your risk tolerance, market knowledge, and the volatility of the assets you’re trading. It’s essential to have a clear trading plan, including stop-loss levels and profit targets, to protect your capital and minimize potential losses in a volatile market.

Conclusion

Trading memecoins with leverage is like riding a roller coaster because it’s thrilling and full of ups and downs. As you jump into this strategy, remember that while the potential for profits is high, so are the risks. It’s essential to do your homework; take a good look at the coins you’re interested in and keep an eye on the on-chain data to spot trends and movements.

You want to know where the big players are putting their money and what’s happening in real-time. And don’t underestimate the importance of managing your risk. Setting stop-losses and take-profits can help you stay on track. That way, even when the market takes a turn, you’re not left in the dust.

Stay strategic, stay informed and most importantly, enjoy the ride! Happy trading and may your trades be profitable!

📚 Similar content you might like:

👉 Bitrefill Gift Card Honest Review 2024 💙

👉 Holyheld review: the best non-custodial crypto card? 💳

👉 The Secret on How to Earn Disney Gift Cards Fast: 7 Easy Ways You Can Start Today! 🎁

👉 Best Gift Cards for Men: my Top 10 Picks 💛

📌 Never miss a new post! Follow us:

👉 Linkedin

👉 X (Twitter)

👉 Facebook

👉 This article is provided by Web3Lens, learn more about us here.